Bonus Depreciation is About to Phase Down to 80% in 2023

- December 29, 2022

- 2:04 pm

- Economy, Taxes

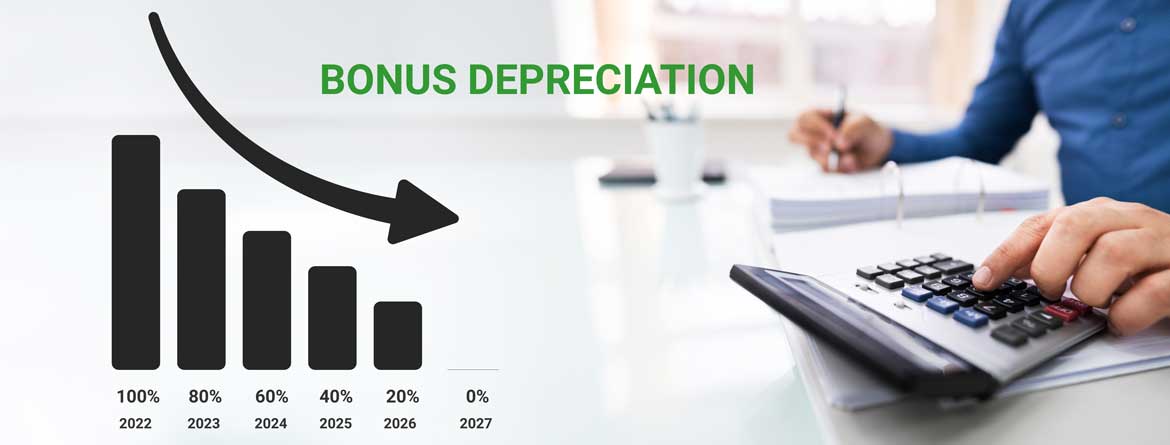

In 2022, IRS Section 179 has a deduction limit of $1,080,00 for equipment and off-the-shelf software, with a spending cap of $2,700,000. After the spending cap of $2,700,000, a purchaser can take Bonus Depreciation of 100%. Starting in 2023, Bonus Depreciation will be reduced from 100% of the purchase price in the first year to 80% of the purchase price. Each year after that, Bonus Depreciation will be reduced by 20% until it reaches $0.

In 2023, the IRS Section 179 deduction limit will be $1,160,000 and the spending cap will be $2,890,000. Any Bonus Depreciation taken after the spending cap of $2,890,000 will only be 80% instead of the 100% allowed in 2022.

2022 is the last year to get the 100% Bonus Depreciation. If you want to purchase equipment or expensive software, such as ERP, CRM or HR software by the end of 2022 to take advantage of Bonus Depreciation, and don’t have the cash flow, financing from Dimension Funding can make it happen. It’ll be tight but it’s doable. Fill out our online application and one of our financing gurus will reach out to you.

Have a wonderful holiday season!

Recent Posts

- Bonus Depreciation is About to Phase Down to 80% in 2023 December 29, 2022

- Tax Benefits of Buying Equipment & Software Before December 31, 2022 December 8, 2022

- How the Inflation Reduction Act Impacts your Business and You and your Family August 16, 2022

- Recession? What Recession? July 27, 2022

- Dimension Funding Has Paperless Financing April 26, 2022