Medical Vendor Financing

Offer your clients financing and close more deals in less time

- Expand your Customers' Potential Buying Power

- One Fixed, Low Monthly Payment for the Purchaser

- Overcome the "How Do I Pay for This" Objection

- Fastest Path to Payment with 100% Early Commencement and Progress Pay Programs

Established in 1978;

Over 40 Years of Providing Financing to Vendors

Increase your sales by offering affordable financing options to your customers

Providing financing alternatives to your customers and prospects, as part of your overall sales strategy, helps your clients expand their purchasing power and is critically important and a most valuable tool to help you close sales.

Expand your Customers' Purchasing Power

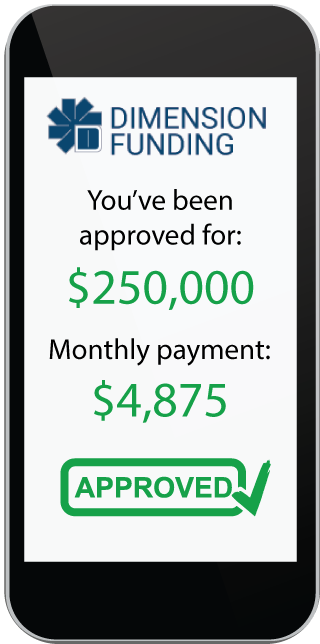

Offer your customers quick and easy financing that will allow them to make one low monthly payment and you to close more deals.

- Offer your prospects NO-HASSLE financing

- Turn prospects into customers

- Accelerate the sales cycle

- Increase transaction size

- Get predictable revenue

- Improve closing ratios

- Prospects can afford big ticket items without reducing cash flow

- Add an additional revenue stream

- Increase profit margins

- Overcome pricing & budget objections ("How do I pay for this?")

Offer your Clients 0% Financing

Instead of offering discounts on your medical hardware or software, offer your prospects 0% financing from Dimension Funding. It takes financing and the interest rate completely off the table.

Beat the Bank Rate

By offering 0% financing from Dimension Funding, your customer has no incentive to “shop around” for better interest rates or financing. Instead, the conversation stays on the benefits of your medical solutions.

100% of Costs Financed

Dimension Funding finances 100% of the cost of the software, implementation including training, professional services, third-party vendors and hardware.

Dimension financing programs are designed to meet the specific needs and goals of our valued vendor partners and their customers. Remember that control of the sales process starts with a discussion of a customers financing requirements which prevents them from having to secure that on their own. By offering customized financing to your customer you are able to accelerate the sales cycle, close more deals and increase profit margins.

Commercial Financing

- Brewery Equipment Financing

- Commercial Equipment Financing

- Construction Equipment Financing

- Used Bulldozer Financing

- Mini Excavator Financing

- Equipment Financing

- Equipment Leasing

- Golf Course Mowers & Equipment Financing

- Business & Hospital Furniture Financing

- IT / Technology Financing

- WISP Financing

- Lab Equipment Financing

- Law Firm Technology Financing

- Material Handling Equipment Financing

- Medical Equipment Financing

- Medical Software Financing

- Restaurant Equipment Financing

- Recycling Equipment Financing

- Small Business Loans

- Software Financing

- Software Renewal Financing

- Tree Service Vehicles & Equipment Financing

- Working Capital

- Financing Application

Equipment & Software Financing Made Simple

Provide Financing Options to your Clients

Client / Vendor Specialties

We provide financing for almost any healthcare vendor, equipment, technology or software. Here is a partial list of some types of healthcare vendors that we support:

- Medical Distributors – selling to Medical, Veterinary and Dental Markets

- Medical Device Manufacturers selling direct

- Systems Integrators – IT

- IT Manufactures / Distributors

- EHR / EMR and other Healthcare Software Publishers

- EHR / EMR Software VARS and Systems Integrators

- Nurse Call Systems Dealers and Manufacturers

- Satellite Systems Dealers

- Rehabilitation Equipment Dealers and Manufacturers

- Office/Lab/Medical Furniture Vendors

- Telecommunications Vendors selling to Healthcare primarily

- Specialty Bus and Van Manufacturers and Dealers

- Custom Emergency Vehicle Manufacturers and Dealers

- Other Miscellaneous Vendors

- M.D. Practices – Specialists and G.P.’s

- Hospitals (Private and Municipal)

- Clinics

- Surgery Centers

- Laboratories

- Cancer Treatment Centers

- Dialysis Treatment Centers

- Mobile X-Ray, Ultrasound and other Mobile Services (5+ years TIB)

- Podiatry Practices (3+ years TIB)

- Veterinarians – Offices and Hospitals

- Dental, Periodontal and Endodontic Offices

- Chiropractic Offices (established – 5+ years TIB)

- Optometry Practices (3+ years TIB)

- University Medical/Dental/Veterinary/Chiropractic Schools – Private and Municipal

- Emergency Vehicle Transport Companies (5+ years TIB)

Long Term Care and Related Facilities – For-Profit and Not-For-Profit

- Skilled Nursing Facilities

- Rehabilitation Facilities

- Memory Care Facilities

- Assisted Living

- Mid and Short Term Care Facilities

- Hospice

Overcome, "How do I pay for this?"

One of the biggest problems facing small to medium-sized businesses is figuring out how to pay for the equipment and software they need without impacing their cash flow.

Financing alternatives from Dimension Funding can solve this problem and increase the number and size of your sales.

Benefits of Offering Financing from Dimension Funding

Close More Deals ... Faster

Offering financing closes more deals faster

No more waiting for bank funding or for the purchaser to find financing.

Financing is good marketing

If a competitor offers financing and you don't, you're more likely to lose the deal.

Expands your customers' purchasing power

With extended financing, small businesses can more easily afford big ticket items.

Most of your customers need financing

Provide quick & easy financing options to your customers.

Payment options are part of the customer's decision-making

Whether you offer financing is factored into the customer's decision-making process.

Fast payment / no more collections

You get paid in full within 24 hours of funding. No more attempting to collect overdue payments.

Fast & Easy ...

- 100% Total Project Financing

- Rapid Credit Decisions Usually Within a Couple of Hours

- Electronic Documentation Expedites Processing and Funding

- Application only up to $250,000 on equipment and $500,000 on software solutions

- Financing For All Pass Through Manufacturers

Creative & Flexible ...

- Financing For Extended Maintenance and Service Contracts

- Creative Rate Programs

- Commissionable Rate Programs

- Dealer and Channel Sales Experts

- Personal Service and Sales Support Throughout the Process From Medical Financing Program Experts

Leasable Collateral

All Medical Equipment and Information Technology to include, but not limited to:

Software / EHR & EMR / Hardware

- EHR/EMR/Records Management/Practice Management/Imaging and all other Software Types

- Software Licenses – Traditional, Cloud and Subscription Models as well (100% Software Leases)

- IT Hardware

Services

- Services – Implementation, Training, Data Conversion, etc. for Hardware/Software Projects

- Services Only – for implementation of some SaaS models

- Managed Services with or without Hardware and/or Software

- Maintenance – up to 5 Years

Medical / Lab Equipment

- Imaging – Ultrasound, X-Ray, CT, PET, MRI, Cardiac Catheter Lab Imaging Equipment

- Ophthalmic Equipment

- Laboratory Equipment

- Respiratory Therapy Equipment

- Physical Therapy and Rehabilitation Equipment / Bathing Rehabilitation and In Ground Pools

- Stress Test Treadmills and other related Testing Equipment

- Nuclear Medicine - Radiation Treatment/Therapy Technology

- Surgical Equipment / Surgical Lighting./ Robotics

Technology

- Patient Tracking and Monitoring Systems

- Nurse Call/Paging Systems

- Telecommunication Systems

- Broadband/Internet Systems

- Satellite TV Systems

- CCTV Systems – Security Systems – Access Control Systems

- Infusion and Medication Management Systems

- RFID Tracking Systems

- Telecommunications Systems and related Technologies such as VOIP and Teleconferencing Systems

Medical Vehicles

- Specialty Busses and Vans

- Custom Emergency Transport Vehicles

Equipment / Furniture

- Exam Tables and Exam Room Furniture

- Furniture, Cabinetry

- Hospital Laundry and Maintenance Equipment

Vendors

Become a Financing Vendor Partner

We work with healthcare software and equipment vendors to provide financing for your prospects and customers. Increase your sales / opportunities by offering financing from Dimension Funding.

Learn more about our financing options and the benefits of becoming a vendor partner of Dimension Funding.