Why Financing your Business Equipment is your Best Move

- July 22, 2020

- 3:00 pm

- Equipment, Section 179, Taxes

Business owners know that the tools and equipment they need to run efficiently can be one of the costliest expenses. Many business owners are already strapped when it comes to loan options because of their start-up loans or not having enough business capital or cash flow to qualify for traditional loans. This lack of funding options can often lead business owners to put off upgrades in their technology and equipment that would otherwise increase productivity and efficiency thus raising profits. Did you know that your options as a business owner are not limited to lines of credit through a bank? Owners need to consider the ways that equipment financing can benefit them when funded through private funding companies.

Benefits of Financing Equipment

Businesses need to be able to purchase equipment, upgrade their technology & software as new advances come out, and the need for other equipment arises. For businesses to remain competitive they need the tools to do so. However, some equipment such as specialized tools, construction equipment, medical equipment & technology, vehicles fleets, and computer technology can cost companies hundreds of thousands of dollars in upfront costs. If you are a small business owner, it is unlikely that you have this kind of cash on-hand or if you do, want to reduce your working capital, particularly during a recession.

You experience an increase in your working capital when you can free up part of your budget through equipment financing. You don’t have to worry about cashflow shortages after paying an exorbitant amount of money upfront for equipment purchases. Use your working capital for operating expenses and growing your business rather than financing your equipment purchases.

Bank Financing vs Financing Company

Banks rarely cover soft costs such as transporting, installation and maintenance of equipment. Those expenses must be paid upfront. With a financing company, those soft costs can be included in the financing.

Banks often require a 20% down payment. Financing companies finance the entire amount including soft costs.

Banks prefer to loan money on a floating or variable rate tied to the Prime Rate. Financing offers a fixed monthly payment. If you finance your equipment purchase, you know exactly what you are going to pay, the monthly payment and for how long.

Financing Turns a Large Upfront Expense into a Monthly Payment

Along with freeing up working capital, another monetary benefit of equipment financing is being able to break the cost of the equipment down into smaller, more manageable fixed, monthly payments for a term up to the life of the equipment. You can treat your equipment loan just as you would any of your other monthly operating bills or invoices and cash in on the tax benefits!

Tax Benefits

Also, under IRS Section 179 you can write off the entire equipment purchase up to $1,040,000. Under IRS Section 179 there is a spending cap of $2,590,000. However, Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. If you finance the equipment purchase, you can write off the entire purchase in the year that your purchased / put the equipment into service but make payments for the term of the financing agreement (often over the life of the equipment).

How to Get Equipment Financing

Equipment financing is usually obtainable through private lenders that supply capital to businesses, entrepreneurs, and owner-operators. These lenders specialize in commercial financing and lease financing for any type of business equipment you might need. Some of these companies, such as Dimension Funding, finance 100% of the costs associated with new equipment purchases including the shipping, installation, and maintenance of the equipment. Business owners can also include training expenses in their funding requests to offset the payroll expense of training employees on how to effectively use the new equipment.

What Types of Equipment Can Be Financed?

- Breweries

- Construction & heavy equipment companies

- IT/Technology based companies

- WISPs & Internet Service Providers

- Law Firms

- Health Services

- Medical Supply

- Restaurants

- Manufacturing

- Industrial

Also included in your equipment financing can be the funds to deliver and install the equipment, provide long-term maintenance, and training your employees on how to use the new equipment—including software! At Dimension Funding even software programs that your company needs to operate such as payroll and accounting software, POS software, and more can all be financed just like your heavy equipment and technology.

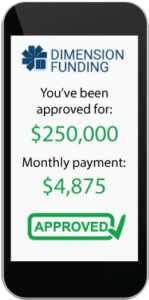

The best way to figure out if your business and equipment needs are eligible for financing is to start the application process with Dimension Funding. One step financing approval is available to get you the answers you need right away.

Recent Posts

- Bonus Depreciation is About to Phase Down to 80% in 2023 December 29, 2022

- Tax Benefits of Buying Equipment & Software Before December 31, 2022 December 8, 2022

- How the Inflation Reduction Act Impacts your Business and You and your Family August 16, 2022

- Recession? What Recession? July 27, 2022

- Dimension Funding Has Paperless Financing April 26, 2022