Financing Promotions Designed Specifically for Zone and Co Clients

- Select the Financing Program that best fits your needs

- Prepare for growth by investing in the right technology

- No large upfront costs; saves working capital

- Combine with other promotions to create a financing program that works for you

with Netsuite & Zone Advanced Billing

Explore Financing Options

Zone and Co

LEARN MORE ABOUT THE BENEFITS OF FINANCING

Financing Promotions for Zone and Co. Clients

We’ve partnered with Zone & Co, a 5-Star NetSuite Solution Provider to make it more affordable than ever to move to NetSuite the #1 Cloud ERP and Zone Advanced Billing, a single powerful platform for ERP and billing. Now is the time to re-tool, automate and build for the bounceback.

With financing from Dimension Funding and the promotions we offer, we are making Zone and Co.’s ERP & Billing Solutions affordable in this time of uncertainty.

Turn the Annual Subscription Into a Low Monthly Payment

Instead of a large annual subscription payment, turn that payment into a fixed, low monthly payment across the term of the subscription. Include all of the project costs such as training, implementation, hardware, third-party vendors and other costs, as a part of that low monthly payment.

- Financing covers 100% of project costs: the software, implementation including training, professional services, third-party software and hardware

- No large upfront costs; saves working capital

- Combine with other promotions to create a financing program that works for you

No Payments for 90 Days

Purchase your software and use it for 90 days before you have to make the first monthly payment. This saves your cash flow and working capital.

You make NO PAYMENTS for 90 days

Saves Working Capital & Cash On Hand

You get Zone & Co.'s products IMMEDIATELY

Use advanced technology to cut costs and increase productivity

Zero Percent Financing Promotion

Depending upon your situation, you may qualify for 0% Financing. Speak with Dave Budman, your Dimension Funding Account Manager, on whether you qualify.

Beat the Bank Rate

By getting 0% financing from Dimension Funding, you don’t need to look anywhere else for better interest rates or financing.

Some restrictions apply.

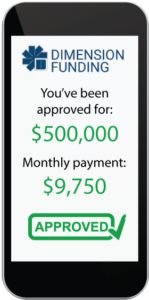

Up to $500k in Application Only Financing

Get “No-Hassle” financing up to $500k without providing financial statements. It’s fast & easy.

- Up to $500k in Application Only Financing; No Financial Statements required

- Financing covers 100% of project costs: the software, implementation including training, professional services, third-party software and hardware

- No large upfront costs; saves working capital

- Turn an annual subscription into a low monthly payment

No-Hassle, Fast & Easy Financing

Retool for the Market Rebound

Experts are predicting a brief deep recession followed by a quick market rebound. Your company needs to be ready when that happens. Updating technologies that cut costs and increase efficiency are an important way of weathering the recession while preparing for the rebound.

Be ready when the economy is turned back on. Your competitors will be.

Estimated Payments, Apply for Financing & Tax Write-Off

Estimated Payments Calculator

Get an estimate of the monthly payments for financing with our Payments Calculator Tool. Enter the amount to be financed and get the monthly payments for terms up to 60 months.

DAVID BUDMAN

Your Dimension Funding Account Manager

Reach out to Dave for more information on any of the promotions. He will work with you to create a financing package that will work best for your company.

Dave has been with Dimension Funding for over 20 years and is well liked and respected by his customers, colleagues and staff. He will listen to your concerns and help you figure out the best way forward.

Quick Apply for Financing

Financing Application David Budman R

EASY APPLICATION. QUICK APPROVALS. FAST FINANCING.

DAVID BUDMAN

Phone: 949-608-2231

Email: dbudman@dimensionfunding.com

Benefits

- Quick Approval / Fast Funding.

- One Low Monthly Payment.

- Exceptional Service.

- 100% of Associated Costs Included in the Financing.

Why Dimension Funding

- Over 40 years of providing financing for the purchase of equipment & software.

- Work with staff that have been at Dimension Funding for over 20 years.

- Exceptional service with quick turnaround.

- A corporate culture that values customers and staff. Treats everyone with dignity & respect.

No-Hassle, Fast & Easy Financing

Testimonial

“We found Dimension Funding to be a very professional organization to work with. They are attentive to our needs and have helped us increase our sales through financing as well as financing several pieces of equipment for our company.”

Bob Bailey

Director of Sales, Carlson Software

IRS Section 179 Tax Deduction

Write off up to 100% of the purchase on their taxes the year purchased under IRS Section 179 for equipment and / or software.* Combine the tax write off this year with the 90 days deferred monthly payments (no payments until next year), and save your working capital.

Learn more about IRS Section 179.

2024 Deduction Limit for Section 179 is $1,220,000

For equipment or software purchases up to $1,220,000, your company can deduct the entire amount from your gross income.*

2024 Bonus Depreciation Limit for IRS Section 179 is $3,050,000

For purchases over $1,220,000 your company still gets the benefit of Section 179 tax write-off with the bonus depreciation of 60%.*

(*Not intended as legal advice. Please consult your tax professional.)