Technology Financing for your Clients

Tools to Increase your Sales

- Accelerate your Sales Cycle

- Improve Closing Rates & Transaction Size

- Increase Profit Margins / Improve your Cash Flow Position

“According to Forrester Research, vendors who offer financing at the point of sale increase their sales on average by 32%. “

Close More Sales by Offering Affordable Financing

Manufacturers, suppliers, resellers and vendors add significant value to their small and medium-sized business when they extend credit to customers with Dimension Funding commercial financing. When vendors provide a meaningful financing option for their customers, sales increase, cash flow improves, margins are protected, and price is optimized

Outsource your Software Financing

Successful vendors, suppliers, resellers and manufacturers outsource the non-core business function of extending credit to customers to Dimension Funding. This allows these businesses to focus on generating sales and maximizing cash flow.

Customers come in all shapes and sizes. Vendors, suppliers, resellers and manufacturers rely on Dimension Funding’s professionalism to preserve end-user customer relationships through careful, thoughtful, account management.

Increase your Prospects' Purchasing Power

Offering financing for your subscription software prospects can make the difference between getting the deal and not getting the deal. Because we finance all of the costs associated with the software purchase, including implementation, third party vendors and hardware, borrowers are able to purchase your software.

- Turn prospects into customers

- Get paid upfront; no more collection issues

- Get predictable revenue

- Increase profit margins

- Prospects can afford big ticket items by financing them over an extended timeframe

- Add an additional revenue stream

- Improve closing ratios

Benefits of Offering Financing

Offering financing closes more deals faster

No more waiting for bank funding or for the purchaser to find financing.

Financing is good marketing

If a competitor offers financing and you don't, you're more likely to lose the deal.

Expands your customers' purchasing power

With extended financing, small businesses can more easily afford big ticket items.

Most of your customers need financing

Provide quick & easy financing options to your customers.

Payment options are part of the customer's decision-making

Whether you offer financing is factored into the customer's decision-making process.

Fast payment / no more collections

You get paid in full within 24 hours of funding. No more attempting to collect overdue payments.

Vendor Tools & Promotions

Vendor Partner Program

As a vendor partner of Dimension Funding, you will get sales and marketing assistance that will aid you in closing deals, creating messaging that works with different prospects, joint marketing efforts and other program opportunities.

We work with you to put together promotions, literature and digital marketing efforts to help you close more deals.

Partner with Dimension Funding and gain a partner dedicated to your success. We provide you with the tools to close more deals and keep existing deals from going dark.

Learn more about our Vendor Partner Program.

IRS Section 179 Tax Deduction

Customers can write off up to 100% of the purchase on their taxes the year purchased under IRS Section 179 for equipment and / or software.*

Combine the tax write off this year with the 90 days deferred monthly payments (no payments until next year), and you have a winning combination for closing more deals.

Learn more about IRS Section 179.

(*Not intended as legal advice. Please consult your tax professional.)

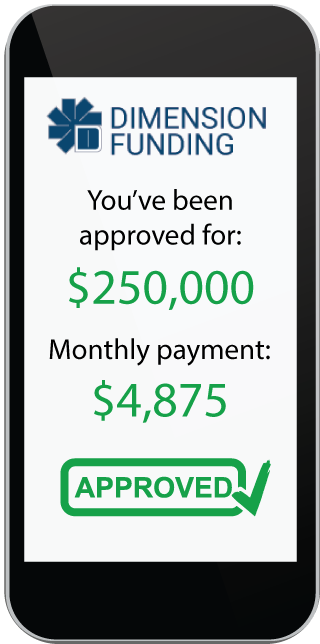

Estimated Payments Calculator

Get an estimate of the monthly payments for financing with our Payments Calculator Tool. A customer can enter the amount to be financed and get the monthly payments for terms up to 60 months.

This tool can be added to your website for the convenience of your clients.

No Payments for 90 Days Promotion

One of our financing promotions includes our “No Payments for 90 Days”. Purchasers of software, equipment, hardware and technology can purchase the equipment, install it and being using it for 90 days before ever making the first payment on it through financing with Dimension Funding.

The purchaser, in addition to not making a payment for 90 days, can write off up to 100% on their taxes this year under IRS Section 179.

Learn more about our “No Payments for 90 Days” promotion. Exceptions apply.

Work with a Partner Who is Focused on Increasing your Sales

Over 40 years of experience helping vendors expand their opportunities

According to a Forrester Research study, offering financing at the point of sale increases sales by 32% on average. If you aren’t providing financing, you are leaving money on the table.

We make it incredibly easy for you to offer your customers financing options. We work with almost any sized vendor from local vendors to national chains.

You get paid in full and your customer gets low, fixed monthly payments on a term that’s good for them.

VENDOR APPLICATION

Established in 1978. Over 40 years of partnering with vendors

Benefits of Becoming a Vendor Partner

- Increases Sales by 32% According to Forrester Research

- Improves Closing Rates

- Raises Transaction Size / Project Scope

- Increases Profit Margins

- Improves your Cash Flow Position

- Get Paid in FULL / No More Collections

Why Dimension Funding

- Work with staff that have been at Dimension Funding for over 20 years

- Focus on good communication and keeping you informed the entire process

- Streamlined Process - Electronic Application / DocuSign

- Fast Approval / Quick Funding; Often Same Day Funding

- Branding & Marketing Support