Financing Promotions Designed Specifically for Doozy Solutions Clients

- Select the Financing Program that best fits your needs

- No large upfront costs; saves working capital

- Combine with other promotions to create a financing program that works for you

Making NetSuite Implementation & Integration Affordable

Contact your Dimension Funding Account Manager

Dave Budman

Phone: 949-608-2231

Email: dbudman@dimensionfunding.com

Financing Promotions for Doozy Solutions NetSuite Customers

Dimension Funding has partnered with Doozy Solutions to make it more affordable than ever to purchase their NetSuite technology solutions including NetSuite Implementation and NetSuite Integration solutions.

If you would like to explore different financing options and the promotions available to you (some restrictions apply), please contact Dave Budman. He can help you find the best financing alternatives for your situation.

No Payments for 90 Days

Purchase your NetSuite technology solution and haver 90 days before you have to make the first monthly payment. This saves your cash flow and working capital.

You make NO PAYMENTS for 90 days

Saves Working Capital & Cash On Hand

Invest in NetSuite Technology

Your source for NetSuite Implementation/Integration Solutions

Turn an Annual NetSuite or Crafted ERP Subscription Into a Low Monthly Payment

Software Renewals and New Subscriptions Qualify

Instead of a large upfront software subscription cost, turn that payment into a fixed, low monthly payment across the subscription term.

Software renewals, annual subscriptions or multi-year subscriptions can all be turned into one low monthly payment.

- One, Low, Fixed Monthly Payment up to the duration of the subscription

- No large upfront costs; saves working capital

- Combine with other promotions to create a financing program that works for you

Renewals and New Subscriptions

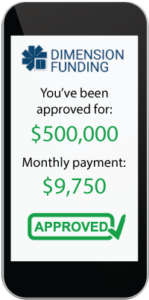

Up to $500k in Application Only Financing

Get “No-Hassle” financing up to $500k without providing financial statements. It’s fast & easy. (Financing for amounts over $500k do require financing statements but the process is still very streamlined.)

- Up to $500k in Application Only Financing; No Financial Statements required

- Financing covers 100% of project costs: the software, hardware, training, implementation and third-party vendors

- No large upfront costs; saves working capital

- Turn a large software purchase into a low monthly payment

No-Hassle, Fast & Easy Financing

Financing Includes NetSuite Implementation & NetSuite Integration Costs

Include all of the project costs such as software, hardware, implementation and training, third-party vendors and other upfront costs, as a part of that low monthly payment.

- 100% of Project Costs can be included in the financing

- Financing covers soft costs such as implementation and training

- Third-party vendors can also be included in the financing

- Software, hardware and other technology are included in the financing

All Project Costs Included in the Financing

Estimated Payments, Apply for Financing & Tax Write-Off

Estimated Payments Calculator

Get an estimate of the monthly payments for financing with our Payments Calculator Tool. Enter the amount to be financed and get the monthly payments for terms up to 60 months.

VinWizard Financing Application

EASY APPLICATION. QUICK APPROVALS. FAST FINANCING.

IRS Section 179 Tax Deduction

Write off up to 100% of the purchase on their taxes the year purchased under IRS Section 179 for equipment and / or software.* Combine the tax write off this year with the 90 days deferred monthly payments (no payments until next year), and save your working capital.

Learn more about IRS Section 179.

2024 Deduction Limit for Section 179 is $1,220,000

For equipment or software purchases up to $1,220,000, your company can deduct the entire amount from your gross income.*

2024 Bonus Depreciation Limit for IRS Section 179 is $3,050,000

For purchases over $1,220,000 your company still gets the benefit of Section 179 tax write-off with the bonus depreciation of 60%.*

(*Not intended as legal advice. Please consult your tax professional.)