The 5 Best Apps for Businesses in 2021

- January 7, 2021

- 4:43 pm

- business technology

Technology has revolutionized the way we do business and has helped us intuitively manage the day-to-day tasks associated with it. Developers are constantly working to make better, more useful tools to aid the ever-increasing number of entrepreneurs in their pursuit of excellence.

In this article, we’ll show you the 6 best apps you should be using for your business. For each one of our choices, we’ll detail their benefits and how you can take advantage of them.

Some might be familiar to you, others might be new, but all of them will definitely help supercharge your workflow!

No best business apps guide could ever be complete without Evernote. A juggernaut in the industry with a legion of loyal customers and overwhelmingly positive ratings, Evernote helps you reduce your businesses’ reliance on paper, and allows you to collaborate and share ideas with your team members quickly and efficiently.

One of the best features of this robust app is the fact that it is tightly integrated with almost every service you can think of. This allows you to fit it into your workflow super easily with no chances of compatibility being an issue. You can save all your important documents and ideas in the app, which will then sync it to your team members and the other devices you use on a day-to-day basis.

Some other notable features include an incredibly sophisticated search tool, templates for to-do lists and notes, sketching capabilities and stylus support, and much more. Trying to list all the reasons you should use Evernote would be a huge undertaking in and of itself, but you can get a good idea of the benefits from this article.

Evernote is free for the basic version, while the Plus version requires a modest annual subscription.

An incredibly popular tool known for its unique feature set and intuitive functions, Expensify is a must-have in your business tool arsenal. It allows business owners to easily track their employee’s work-related expenses by logging them into the app.

Expensify lets you upload receipts using any android or iOS device. They have other options too which include OCR smart scan, uploading a picture on their official website, or even using a Google Chrome extension. The app then records all this data for you making end of year reports and analysis that much easier.

With a great drag and drop interface, and the ability to extract images from receipts for expense reports, Expensify is a great tracking tool for small business owners. While it may not be as densely packed as other finance trackers, it does what it was created for reliably without fail. Best of all, it’s free for you to try.

The Google Suite of productivity apps includes Gmail, Google Docs, Google Sheets, Google Slides, and more. These apps might not be as popular as their Microsoft counterparts, but they have an advantage that is quite simply unmatched. Using Google’s exceptional cloud storage software, these apps sync and update their content better than any other service on the market.

This makes real-time collaboration incredibly simple and intuitive with easy options to edit documents and text files on the go. As the apps are all internet-based, you can access them from anywhere with any device as long as you have a decent connection.

The basic version is completely free to use and only requires your Google id to sign in; a great option for small businesses that only need a couple of people to collaborate together. There are other subscription-based options for you to choose from if your needs are more intensive. You can find them all here.

Asana is a feature-packed project management app that is designed to keep your team members focused on the task at hand. Most project management software solutions are very complex with cluttered interfaces and settings but Asana is the complete opposite.

The app uses “boards” to intuitively follow the progress of any project and to delegate tasks between team members. The visual representation is easy to follow and with options to share notes, files, and deadlines within the app itself, the chances of missing targets or miscalculating are greatly reduced.

It also offers plenty of useful integrations with larger, more popular programs like Google Drive, Dropbox, etc, all of which help to make it the complete project management package. The app is free to use as a basic service with an option for subscription-based upgrades if you want everything.

It might surprise you to find a graphic design app on this list, but the benefits that Canva provides, especially for businesses that don’t have an in-house designer, are massive. Canva is a tool loaded with easy-to-use features and amazing functionality to create engaging content that is easy to share.

Perfect for businesses looking to level up their social media game, Canva has a plethora of templates for them to choose from. Instagram posts, social media banners, marketing materials, presentations, ads, and posters can all be designed within the app itself.

With social media becoming more and more important, having a strong presence is a necessity for businesses looking to take things to the next level and Canva might just help you do exactly that. The basic app is free to use with more advanced features available to unlock should you need them.

Recent Posts

- Bonus Depreciation is About to Phase Down to 80% in 2023 December 29, 2022

- Tax Benefits of Buying Equipment & Software Before December 31, 2022 December 8, 2022

- How the Inflation Reduction Act Impacts your Business and You and your Family August 16, 2022

- Recession? What Recession? July 27, 2022

- Dimension Funding Has Paperless Financing April 26, 2022

One benefit that comes with equipment financing over bank financing the bank requires a “Blanket Lien” meaning that all of assets of the company are security for the financed equipment. With a financing company, the financing is unsecured with only the equipment as security.

One benefit that comes with equipment financing over bank financing the bank requires a “Blanket Lien” meaning that all of assets of the company are security for the financed equipment. With a financing company, the financing is unsecured with only the equipment as security. The tax benefits of financing your equipment purchases should also be something business owners take into consideration when deciding on financing equipment. When you make financing payments, you are paying on the interest in addition to the amount applied towards the purchase price of the equipment. The interest payment portion of your loan is tax deductible each year that you are paying on the loan.

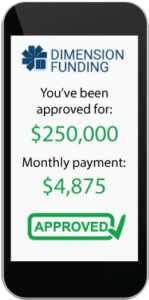

The tax benefits of financing your equipment purchases should also be something business owners take into consideration when deciding on financing equipment. When you make financing payments, you are paying on the interest in addition to the amount applied towards the purchase price of the equipment. The interest payment portion of your loan is tax deductible each year that you are paying on the loan. Applying for these loans are easy and simple. You can apply for up to $250k without providing financial statements and if you need more than that, the paperwork process is streamlined for your convenience. When you

Applying for these loans are easy and simple. You can apply for up to $250k without providing financial statements and if you need more than that, the paperwork process is streamlined for your convenience. When you