Software Vendor Financing Services

Supercharge your Sales by Providing Financing to your Clients

- Expand your Customers' Potential Buying Power

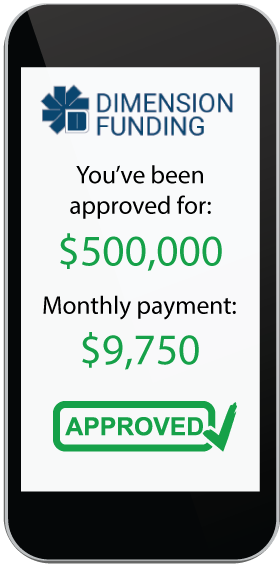

- Up to $500k Application Only Financing

- Overcome the "How Do I Pay for This" Objection

- Accelerate the Sales Cycle

Offer Software Financing from Dimension Funding

Established in 1978

Over 40 Years of Providing Vendor Financing

Close More Sales by Offering Affordable Financing

Manufacturers, suppliers, resellers and vendors add significant value to their small and medium-sized business when they extend credit to customers with Dimension Funding commercial financing. When vendors provide a meaningful financing option for their customers, sales increase, cash flow improves, margins are protected, and price is optimized

Partner in Success

Successful vendors, suppliers, resellers and manufacturers rely on Dimension Funding as their financing partner to proactively implement financing programs. As your partner in success, we are ready to help you leverage new business and upgrade existing clients.

Customers come in all shapes and sizes. Vendors, suppliers, resellers and manufacturers rely on Dimension Funding’s professionalism to preserve end-user customer relationships through careful, thoughtful, account management.

Increase your Prospects' Purchasing Power

Offering financing for your subscription software prospects can make the difference between getting the deal and not getting the deal. Because we finance all of the costs associated with the software purchase, including implementation, third party vendors and hardware, borrowers are able to purchase your software.

- Turn prospects into customers

- Get paid upfront; no more collection issues

- Get predictable revenue

- Increase profit margins

- Prospects can afford big ticket items by financing them over an extended timeframe

- Add an additional revenue stream

- Improve closing ratios

Take Advantage of IRS Section 179 Tax Benefits

Clients purchase your software while reducing their 2022 taxes

Clients write off the entire purchase on their 2022 taxes.* If they qualify for the deferred payments, their first payment is 90 days after they purchase the software.

2022 Deduction Limit for Section 179 is $1,080,000

For equipment or software purchases up to $1,080,000, companies can deduct the entire amount from their gross income.*

2022 Bonus Depreciation Limit for IRS Section 179 is $2,700,000.

For purchases over $1,080,000, companies still gets the benefit of Section 179 tax write-off with the bonus depreciation.*

*Clients need to check with their tax professional to ensure that they qualify for any tax write-off.

Benefits of Offering Financing

Close more deals faster

No more waiting for bank funding or for the purchaser to find financing.

Financing is good marketing

If a competitor offers financing and you don't, you're more likely to lose the deal.

Expands your customers' purchasing power

With extended financing, small businesses can more easily afford big ticket items.

Most of your customers need financing

Provide quick & easy financing options to your customers.

Payment options are part of the customer's decision-making

Whether you offer financing is factored into the customer's decision-making process.

Fast payment / no more collections

You get paid in full within 24 hours of funding. No more attempting to collect overdue payments.

Why Financing from Dimension Funding

No Financials Required Up to $500k

No other finance company offers the ease of getting capital this quick. Good credit = Approved!

Quick Approvals

Most of the time no application is required, simply give proposal or quote to us and we will have an approval within 24 hours.

Industry Expertise

We understand your business and the flexibility needed to get transactions done.

Simple Documentation

Dimension Funding prepares all the paperwork and DocuSign is available on most transactions. Your client signs a few pages and they are done!

Multi-Year Subscriptions

Customers don’t use ERP or CRM Software for One Year. Why Should They Purchase a One-Year Subscription?

- Get 100% financing on the cost of the subscription, implementation and professional services and third party software.

- Flexible financing offers purchasers a variety of subscription & software services

Partnering with Dimension Funding

Branding / Marketing Support

We provide literature and marketing support for your dealers and sales teams on financing alternatives available to your customers. It makes the process simple and easy.

Fast Process

We generate quotes and process applications usually within an hour or two. It's fast, simple and easy.

Exceptional Service & Support

We partner with you to help you generate more business. Our team offers exceptional service and support to our vendor partners and to borrowers.

Tailored Financial Alternatives

We offer financing alternatives tailored to the needs of your customer. Instead of a one-size fits all solution, we offer a variety of financing options. This allows you to close more deals faster.

Electronic Applications

Your customer can take care of the application online. It's quick. It's easy. Very little paperwork and in many cases, no paperwork at all.

Longevity

Over half of our sales team have been with us for over 20 years. Some as long as 30+ years. Many of our clients have been with us for almost as long. Our corporate culture is unique in the industry.

Flexible Financing Options for your Clients

Bundled Services

Our financing solution combines a software subscription, services and equipment from other manufacturers for one easy monthly payment for the purchaser.

Maintenance & Services Only

Services can be financed on a standalone agreement for a term matching the length of the service contract.

Multi-Year Subscriptions

You get Pedictable income streams without fear of default. The purchaser locks in a fixed rate over the term of the contract.

Become a Vendor Partner

Accelerate your Sales Cycle; Increase Profit Margins

We work with almost all types of equipment vendors & software vendors to provide financing for your clients. Accelerate your sales cycle, improve your closing rates and increase your profit margins by offering financing from Dimension Funding.

Learn more about the benefits of having Dimension Funding as your financing partner.