Equipment Leasing

All the benefits of buying without the upfront costs

- Structure the Lease Financing Agreement to Meet your Goals

- Transportation, Installation & Maintenance Costs Included in Financing

- One, Fixed Low Monthly Payment

Over 40 years of providing financing to small and medium-sized businesses

Get up to $250,000 without needing financials.

Equipment Leasing Financing

Get up to $250k in equipment leasing or financing without needing financials. Financing over $250k does require financial statements.

Dimension Funding offers a variety of financing options including equipment leasing where you can get the equipment you need to expand your business or replace obsolete equipment.

Outsource your Software Financing

Successful vendors, suppliers, resellers and manufacturers outsource the non-core business function of extending credit to customers to Dimension Funding. This allows these businesses to focus on generating sales and maximizing cash flow.

Customers come in all shapes and sizes. Vendors, suppliers, resellers and manufacturers rely on Dimension Funding’s professionalism to preserve end-user customer relationships through careful, thoughtful, account management.

Get the Equipment you Need from the Vendor of your Choice

Select any equipment vendor and Dimension Funding will provide multiple financing options to you. We specialize in providing financing to small- and medium-sized businesses. Rather than using up your available capital resources, you can get leasing or financing up to a term of 60 months.

- One low monthly payment

- No upfront costs

- Financing includes shipping, installation and maintenance costs

- Up to $250k without providing financial statements.

- Over $250k you have to provide financial statements but it is still a streamlined process.

- Funding within 48 hours

IRS Section 179 Tax Write Off Benefits

Depending upon whether you opt for an operating lease or a capital lease, you may be able to get IRS Section 179 depreciation benefits.

Write Off Up to 100% on your Taxes

If the lease is structured as a capital lease, you may be able to write off up to 100% of the cost of the equipment on your taxes. A capital lease looks very much like financing and allows you to claim depreciation of the equipment.

Learn more about Section 179 Tax Benefits.

Keep your Working Capital / Lines of Credit

Instead of using your working capital or lines of credit for purchasing equipment, get a financing lease and preserve your working capital and credit for your business activities.

Commercial Financing

- Brewery Equipment Financing

- Commercial Equipment Financing

- Construction Equipment Financing

- Used Bulldozer Financing

- Mini Excavator Financing

- Equipment Financing

- Equipment Leasing

- Golf Course Mowers & Equipment Financing

- Business & Hospital Furniture Financing

- IT / Technology Financing

- WISP Financing

- Lab Equipment Financing

- Law Firm Technology Financing

- Material Handling Equipment Financing

- Medical Equipment Financing

- Medical Software Financing

- Restaurant Equipment Financing

- Recycling Equipment Financing

- Small Business Loans

- Software Financing

- Software Renewal Financing

- Tree Service Vehicles & Equipment Financing

- Working Capital

- Financing Application

Financing Made Simple

to your Clients

Leasing Over Financing

Leasing can be more financially attractive than financing depending on your situation. With an equipment lease, technically you don’t own the equipment. However, depending upon on how the lease is structured, leasing can be almost indistinguishable from financing equipment.

If you want to be able to write off the equipment on your taxes or if you need to keep your working capital / lines of credit, there is a leasing option available to you. Capital leases allow you to write off up to 100% of the depreciation of the equipment under Section 179 of the IRS code. For some companies, an operating lease doesn’t show up on your balance sheet and therefore doesn’t impact your debt to credit ratio. Although on 12/15/2019, accounting reporting rules for leases will change for privately held businesses and almost all equipment lessees will have to show the lease as a liability on their balance sheet.

Benefits of Leasing Equipment with Dimension Funding

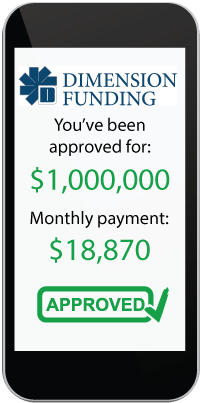

No Financials Required Up to $250k

No other finance company offers the ease of getting capital this quick. Good credit = Approved!

Quick Approvals

Most of the time no application is required, simply give proposal or quote to us and we will have an approval within 24 hours.

Industry Expertise

We understand your business and the flexibility needed to get transactions done.

Simple Documentation

Dimension Funding prepares all the paperwork and DocuSign is available on most transactions. Sign a few pages and you are done!

Advantages of Equipment Leasing

No Upfront Costs

No down payment or upfront costs. Just one fixed, monthly payment for a term up to 60 months.

One Fixed Low Monthly Payment

You lock in a monthly payment that is best for your company. By spreading out the cost of obtaining equipment, you maintain your cash flow.

Write Off Up to 100%

A lease can be structured as a Capital Lease so that you can write off up to 100% of the cost under Section 179 of the IRS Code.

Keep your Available Credit

A lease can be structured as an Operating Lease so it doesn’t impact your ability to get more credit. However, this would impact your ability to claim the Section 179 Deduction on your taxes.

When it comes to financing or leasing, there are multiple leasing options available to you. Fill out a quick quote form and one of our leasing specialists will help you find the best financing option available to you based on your unique situation and goals.

ONE STEP APPROVAL

Get a quick, no obligation equipment leasing quote.

QUESTIONS? CALL US!!

1.800.755.0585