Offer Software Subscription Financing, Including Implementation Costs, with NO Payments for 90 Days

- You Increase the Number & Size of your Deals

- Your Clients Make No Payments for 3 Months

- Combine with the IRS Section 179 Tax Write-Off for 2024

Over 40 Years of Providing Financing to Small and Medium-sized Businesses

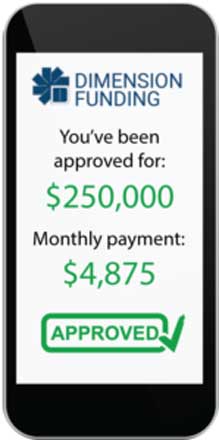

Often Same Day Approvals

Funding within 48 Hours

Get More Information

Get Information R

LEARN MORE ABOUT THE BENEFITS OF FINANCING

A+ Rating from the BBB

Combine our Deferred Payments with Section 179 Tax Deductions

No Payments for 90 Days; Vendors Get Paid Upfront

Take advantage of our current promotions to help your clients get the financing they need while increasing your sales.

Our promotions allow you to offer financing that gives your clients the opportunity to purchase subscription software (plus implementation costs) and hardware now with monthly payments starting in 90 days.

We finance almost any type of subscription software or hardware. 100% of the project costs can be bundled and financed with the software resulting in one, low monthly payment for your client.

No Payments for 90 Days

Implementation Costs Can Be Turned Into Monthly Payments Over Several Years with a One-Year Subscription

Your clients can finance the first year of the software subscription and bundle in the implementation costs and finance the bundle over 3, 4 or 5 years. At the end of the first year, they can then call us to finance year two of the software subscription when it’s due or pay out of pocket. Same with subsequent years.

This is an alternative financing option instead of matching the length of the software subscription to the term of the financing.

This helps you lower the burden of entry for clients who may need their software vs buying multiple years of software upfront just so they could finance both the software and the implementation costs over a longer period than 12 months.

Take Advantage of IRS Section 179 Tax Benefits for 2024

Your customers purchase your software while reducing their 2024 taxes.

2024 Deduction Limit for Section 179 is $1,220,000

For equipment or software purchases up to $1,220,000, your company can deduct the entire amount from your gross income.*

Your clients should consult their tax professional. Not intended to be legal advice

2024 Spending Cap Limit for IRS Section 179 is $3,050,000.

For purchases over $1,220,000, your company still gets the benefit of Section 179 tax write-off with the bonus depreciation of 60% after the spending cap is reached.*

Close More Deals

This combination of tax incentives & financing promotions will help you close more deals, faster.

- Turn prospects into customers

- Helps customers conserve end of year cash & working capital

- Clients can take advantage of IRS Section 179 and write off the purchase on their taxes

- Accelerate the sales cycle

Overcome Budget Objections ("How do I pay for this?")

Electronic Applications / DocuSign speed up the process.

- Prospects can afford big ticket items without reducing cash flow.

- One fixed, low monthly payment

- Up to $500k in Application Only financing

- 100% of Project Costs are included in the financing

We provide approvals usually within a few hours (with some exceptions). Upon approval, funding is often within 48 hours.

Benefits of Offering Financing from Dimension Funding

Offering financing closes more deals faster

No more waiting for bank funding or for the purchaser to find financing.

Financing is good marketing

If a competitor offers financing and you don't, you're more likely to lose the deal.

Expands your customers' purchasing power

With extended financing, small businesses can more easily afford big ticket items.

Most of your customers need financing

Provide quick & easy financing options to your customers.

Payment options are part of the customer's decision-making

Whether you offer financing is factored into the customer's decision-making process.

Fast payment / no more collections

You get paid in full within 24 hours of funding. No more attempting to collect overdue payments.

About Dimension Funding

We work with almost any equipment or software vendor and have clients across industries.

Dimension Funding has been providing financing to small and medium-sized businesses for over 40 years. We are a leader in providing financing to equipment and software vendors.

Most of our staff have been with us for 10 years or more. Much of our sales team has been with us for over 20 years. We have a corporate culture that fosters longevity, not only internally, but with our vendors and borrowers. Many of our clients have been with us for years.

Copyright 2024. All Rights Reserved

Call Us: 800-755-0585